The Tipping Point: Ethereum's Battle for Blockchain Supremacy

The Ethereum network was the first blockchain network designed primarily to be a platform for computation. Unlike its predecessor Bitcoin which was designed to be a digital currency (and evolved into digital gold), the vision of Ethereum was to be a Next-Generation Smart Contract and Decentralized Application Platform as per its whitepaper .

Proponents of Bitcoin may argue that their platform is superior for decentralised apps for a variety of misguided arguments, but seeing where much of the decentralised application innovation has taken place with tokens, NFTs, DeFi and DAOs, its hard to counter Ethereum's position as the leading and de-facto platform for a significant chunk of the innovation taking place in crypto and web3.

The race for mainstream adoption and the emerging challengers in the Web3 landscape

Ethereum isn't without its limitations as we've seen with various alt-layer one networks emerging, and a plethora of layer two scaling solutions now competing to level up the capabilities of the Ethereum network. However, if one takes into account the overall size of the Ethereum community based on all of the companies working with and investing in it, it's hard to see it being displaced.

A GPT moment

It is important to consider where we are in the overall evolution of blockchain and web3 technology as far as mainstream adoption is concerned. "We're still so early" and more recently "Blockchain needs a ChatGPT moment" sum this up.

For blockchains to truly go mainstream they need a mainstream use case that sees everyday people ape into them. There have been aspects of this with crypto — over 400 million people globally hold crypto. But this is primarily for financial speculation, not utility.

When blockchain technology has its ChatGPT moment, we will see previous phases of growth in blockchain technology pale into insignificance, due to the sheer volume of users that suddenly start using this technology.

This growth is likely to happen on an Ethereum layer 2 network, as that is where the network has the ability to scale to a much larger volume of transactions and hence users. However, it is not guaranteed.

Unlike 6 years ago, we're now in a place where there are lots of different networks competing for users’ attention. If one of these networks was able to create a killer use case (I don't like to draw analogies with NFTs or DeFi, as these have primarily been about financial return for users), that network could jump ahead of the competition and establish a first mover advantage.

Mainstream users won't care about the technology, they will care about the ease with which they can do what they want to.

Nifty Keys

For instance, imagine there's a project ‘Nifty Keys’ which enables me to mint NFTs that provide access to my house. Just like house keys, I can issue NFTs to people that need access to my house including myself, my wife, cleaner, nanny for our kids, and a neighbour in case of emergencies.

Unlike keys, these NFTs could have additional privileges associated with them such as only allowing our cleaner to access the property on days they're due to be cleaning, or only letting our nanny access the house on school days.

Next, imagine that Nifty Keys become so ubiquitous that everyone starts phasing out physical keys because Nifty Keys are so much easier to manage. People can use a wallet app on their phone which behind the scenes uses some variant of the well-known NFT token standard.

These main-stream users of Nifty Keys are only going to care about a couple of things with their keys — that the user experience is frictionless, it's secure and reliable. There is no reason why such a technology has to end up on Ethereum or an Ethereum network.

Given the target market for Nifty Keys are homeowners with smartphones, you have a gargantuan total addressable market should the idea gain significant traction. Those end users will not care about the underlying technology being used. Hence if someone can create a technology that sees widespread adoption due to its real-world utility using blockchain, it could shift the blockchain landscape significantly were it to be done on one of the smaller, less well-known chains.

Scaling solutions

I don't believe that it will play out this way, but it is certainly possible, and those naysayers who'd labelled Ethereum the MySpace of web3 would have their moment of glory. Anyway, the point is that one shouldn't discount all of the alt-layer one technologies just yet, those that are positioning themselves as being app-specific chains may well be able to find valuable niches in the long run.

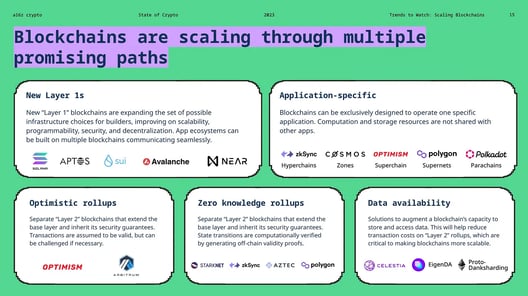

This landscape was nicely illustrated a16z's State of Crypto 2023 Report.

It provided a useful snapshot of the current landscape of new layer1s, application-specific chains or app chains, rollups and data availability layers. What was particularly useful is that they weren't trying to map out the entire ecosystem, but selected the leading protocols within these categories making it helpful as a jumping-off point for people to come to their own conclusions.

The EVM still dominates the landscape, but I believe we will see significant growth in the next year in the app chains and data availability layers. Rollups and data availability layers will be technologies that underpin many of the application-specific chains like the layer 1s themselves.

Whereas app chains will become increasingly focussed on addressing specific challenges in industry with blockchain networks. It is in effect the end-goal for many private-permissioned blockchains.

The EVM still dominates the landscape, but I believe we will see significant growth in the next year in the app chains and data availability layers. Rollups and data availability layers will be technologies that underpin many of the application-specific chains like the layer 1s themselves.

Whereas app chains will become increasingly focussed on addressing specific challenges in industry with blockchain networks. It is in effect the end-goal for many private-permissioned blockchains.

The great interop debate

Approaches to interoperability will become more relevant as the app-chain landscape grows. Imagine you have an asset issuance app chain and a payment app chain. Those chains which are within a specific blockchain ecosystem will be able to interoperate without too much friction, such as between Optimism Superchains or Polkadot parachains.

Transferring assets between ecosystems will be harder and likely require bridges or firms willing to shoulder the risk of provisioning and maintaining this infrastructure. Whether it can become as seamless as moving assets between TCP/IP networks is a noble goal, but perhaps too far-fetched given the diversity of protocols we already have.

Crossing the chasm

No one knows when blockchains and web3 will cross the chasm, and provide utility to the majority of digital citizens, that lives up to its potential that those of us working in web3 wish to provide. There will be financial plumbing that uses it at scale to serve parts of the wholesale financial markets in the next 3-5 years and we already have plenty of people using it for financial purposes. But the true utility which provides sovereignty benefits and solves everyday problems for people could be longer.

If the growth of AI is anything to go by, we could still be looking at a 10-20 year time horizon for it to fulfil its potential, and there is no guarantee as to which ecosystem this will be on. So it’s worthwhile not being too closed-minded on this front and instead focused on those projects that will have the longevity of 10-plus years.