FTX Fallout

10 days ago you could not have imagined the events that just played out in crypto. With Sam Bankman-Fried or SBF as he’s known, the 30-year-old billionaire darling of crypto, seeing his entire empire collapse.

Crypto has its 2008 moment

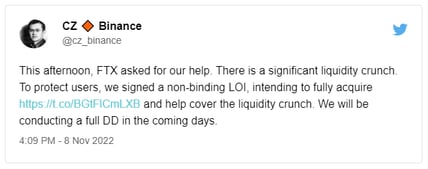

The FTT token, the native token of the FTX exchange dropped from $19 to under $4 in a matter of hours (it’s hovering at $1.50 at the time I write this), and CZ of Binance announced that they’d signed a non-binding letter of intent to fully acquire SBF's exchange, FTX.com.

One day later Binance announced that they weren’t willing to see the deal through. No doubt there was a combination of concerns around the solvency of the remaining FTX and Alameda assets, and the regulatory scrutiny such a deal would come with.

Binance was already the largest crypto exchange by a significant margin. If this deal had moved forward, there would have no doubt been further concerns raised about Binance’s influence on the crypto market — their BSB token and BUSD stablecoin are the #5 and #6 largest coins by market cap with $44bn and $23bn respectively. This represents roughly 8% of the entire crypto market cap, and one can only speculate the number of crypto assets they hold in custody too. For more background on the rivalry between CZ and SBF, the below thread sums it up well (this was published before CZ walked away from the deal).

Here's the 30 second summary of the FTX drama that is blowing up in crypto.

— Shaan Puri (@ShaanVP) November 8, 2022

1/ How FTX (a multi billion dollar co) almost died overnight

2/ And why this is a god tier strategic move by @cz_binance

The straw that broke the camel’s back here was SBFs activities in Washington with respect to trying to influence crypto regulation. The avenue he was pursuing with regulators did not align with CZs goals with Binance, which resulted in CZ unwinding Binance’s multi-billion dollar position in the FTT token, kicking off market contagion. The question no doubt on many people’s minds now is, what this means for web3.

The activities of SBF have set the entire crypto industry back significantly. During this year, SBF had been busy wooing regulators such as the SEC's chair Gary Gensler, and the CFTC with their proposal to help automate margin calls. Additionally, he’d been very active in Washington, having made approximately $40m in political donations to both democrat and republican candidates. In this respect, SBF was doing more than anyone else had previously to influence the regulatory and political landscape, but the fact that he was a fraud, and duped so many people is a bitter pill to swallow, and unfortunately, this means crypto will need to re-earn this trust with potential policymakers and many of its users, which will take time.

Because #web3 is far bigger then just #crypto

— csvensson.eth 🦇🔊 ∞ (@ConorSvensson) November 12, 2022

Web3 is far bigger than just crypto, and for proponents of decentralisation and web3 technology, the events of the past week have left many wanting to double down on the core premise of web3 — decentralised applications and protocols that do not rely on centralised intermediaries such as FTX.

In 2021, we saw two parts of the web3 ecosystem flourish and become mainstream — crypto and NFTs. The vast majority of the activities in these assets were driven by financial speculation. Early investors in crypto projects or NFTs could see their investments skyrocket, generating returns of 100x or even more. Whilst this brought many new users to the table, it wasn’t necessarily the best thing for the industry, as it wasn’t the utility of these assets driving their growth, it was the price appreciation. This meant for a majority of users, making money was the primary use case. These users would likely store their assets on an exchange, as it was the easiest option. Some would have started using their own wallets to store them, but given the additional complexities of this, many would likely have stuck to what was simplest.

This influx of new users, also brought with it increased scrutiny, as naive users need to be protected as much as possible. It’s questionable if web3 is truly ready for mass adoption yet, given the challenges these users would face with using its native rails, due to the unforgiving nature of many decentralised protocols when users make mistakes.

I don’t mean to understate the significance of how far we’ve come with respect to on-chain protocols and innovations such as NFTs, DeFi and DAOs. The web3 ecosystem is incredible. However, there are still usability challenges which is why centralised platforms for their convenience alone remain the default option for most. The question now becomes one of when the next big growth phase happens with web3, will it be with centralised gateways at the forefront or decentralised protocols that have managed to solve many of the usability challenges that plague current users?

There is little doubt of the utility of blockchain and other web3 technologies. Throughout the tumultuous events of the past week, the decentralised protocols and assets that were held in custody by users remained safe throughout. Unfortunately for many exchanges, it has been these crypto bank-runs where users have pulled assets off-exchange that have created the big crunch experienced by first FTX but also hitting other exchanges such as BlockFi and Crypto.com.

Whether these other exchanges can remain fully solvent remains to be seen, but one hopes for the sake of the users that they do. For many web3 projects and protocols, it is business as usual. Yes, they have seen the value of some of their assets drop significantly, but this does not challenge the viability of web3. It is this belief in the underlying potential of the technology that keeps builders building, not the price of crypto assets or centralised entities getting hacked.

The public’s faith in web3 via crypto has unfortunately been challenged. But having a quiet period is good for innovation and getting things done, without new entrants being caught up in the hype. It has been a difficult week, but it hasn’t changed the views of the proponents of web3, and this is what will ensure this technology keeps moving forwards into the future.