The New Frontiers of TradFi

Last week saw a couple of major announcements coming from enterprises with their blockchain initiatives. These are changing the face of TradFi. First, we had Fnality close a £77.7m funding round led by Goldman Sachs and BNP Paribas. Then J.P. Morgan announced their latest milestone with project MAS, where they tokenized funds with alternative asset manager Apollo Global.

Both of these announcements demonstrate that enterprise blockchain initiatives are showing no sign of abating. The ongoing work by both of these firms in the space has significant implications for blockchain in TradFi, which both deserve greater discussion.

How Fnality is building new rails for wholesale payment

Fnality is one of the longest-running enterprise blockchain initiatives. The project was conceived back in 2015, by a consortium of the world's leading banks. It was initially named the Utility Settlement Coin or USC project and spun out into its own dedicated company, Fnality in 2019.

The goal of Fnality has always been to be a real-time wholesale payment system for a number of the world's leading currencies, including GBP, EUR, USD, JPY and CAD.

Since its inception, the focus of Fnality has been on launching its platform for GBP payments. At present, GBP payments are due to be going live before the end of 2023. These GBP payments represent wholesale payments between regulated financial entities.

This is effectively payments between the accounts of regulated banks held at the Bank of England.

The omnibus account is used to represent funds on the Fnality network, which uses a private Ethereum deployment, with GBP represented as a fungible, ERC-20 style token.

If it sounds similar to CBDC's, you'd be correct. The Fnality payment system is considered a synthetic CBDC.

This latest investment of £77.7m is the second major funding round by Fnality. It closed its £55m series A round in June 2019.

When you refer to the investor list of this latest round, it's clear how significant the institutional appeal of their product is. The round was led by Goldman Sachs and BNP Paribas, with participation from DTCC, Euroclear, Nomura and WisdomTree. There were also additional investments from Series A investors Banco Santander, BNY Mellon, Barclays, CIBC, Commerzbank, ING, Lloyds Banking Group, Nasdaq Ventures, State Street, Sumitomo Mitsui Banking Corporation, and UBS.

For a project to have been running for 8 years, raised over £130m in funding and still not live may raise eyebrows. However, these numbers are illustrative of how challenging it is to bring blockchain-based systems into the highly regulated financial markets.

The technology for Fnality has been available since its inception. It has improved since then, but the ability to run a private Ethereum network and develop a tokenized version of GBP is not where the main challenge lies.

It is in the legal frameworks required to operate the network. Significant portions of the investments in Fnality will have been apportioned to working with regulators to enable the payment network to operate. The creation of the omnibus account with the Bank of England is one such example. No doubt there were many more.

Wholesale payment systems are of critical importance to central banks. Bringing in a new type of payment system needs to be performed in a highly risk-averse manner. With this in mind, it's no wonder that the project has taken this long to go live.

However, Fnality's investors will be aware of this and the significance of what it has managed to achieve thus far. Which is why they continue to get behind the project.

J.P. Morgan and Apollo are tokenizing funds

Just one day after Fnality's announcement, J.P. Morgan announced they had undertaken a proof of concept exercise with tokenizing funds.

Working alongside Apollo Global as part of the Monetary Authority of Singapore's (MAS) ‘Project Guardian’, funds were tokenized and transferred between several different blockchains.

The project is the second to come out of J.P. Morgan as part of MAS's Project Guardian. Last year, working with DBS Bank they undertook a regulated DeFi trade using the Polygon network.

The goal of Project Guardian is to use cross-industry pilots to establish policy guidelines and a framework for regulated DeFi. Core areas of focus include interoperability, tokenization, and establishing trust anchors.

In this latest initiative, the focus was on how by utilising tokenized assets on blockchains, the technology could enable a portfolio manager to seamlessly manage a large number of discretionary portfolios, comprised of an array of tokenized traditional and alternative investments across various blockchains, all whilst preserving unique investor-level account customizations.

Fund vehicles from J.P. Morgan Private Bank, Apollo and Wisdom Tree were tokenized on several permissioned blockchain networks.

It came as a surprise to see J.P. Morgan working with so many other participants on this project. Rather than simply requesting everything being done on just their own Onyx Digital Assets network, they also used a private Provenance Blockchain using Cosmos and an Avalanche Supernet.

Interoperability solutions from Axelar and Layer Zero were also used to transfer assets between blockchains.

This approach of using tokenized assets with smart contracts can drastically simplify the portfolio management process and bring greater liquidity to alternative assets. Numbers stated by the report include:

-

It could create a $400m revenue opportunity for alternative fund managers as well as increase access to alternative investments in more traditional portfolios.

-

Rebalancing of opportunities could go from being a process consisting of 3000 steps to requiring only a few clicks.

-

The need for 3% held in cash in most portfolios could be almost entirely reduced with real-time settlement

The numbers are impressive, and the idea of tokenizing funds and portfolios is a no-brainer opportunity for blockchain technology.

However, it's important to keep in mind that all of the blockchain networks used were private permissioned networks and that this was a proof of concept. Public networks will likely be applicable to parts of TradFi long term, but it will depend on what type of assets are being tokenized and who the end users are.

Stablecoins and native crypto assets will remain on public networks, but large wholesale transactions within clear regulatory jurisdictions could well remain on private networks.

The long road ahead

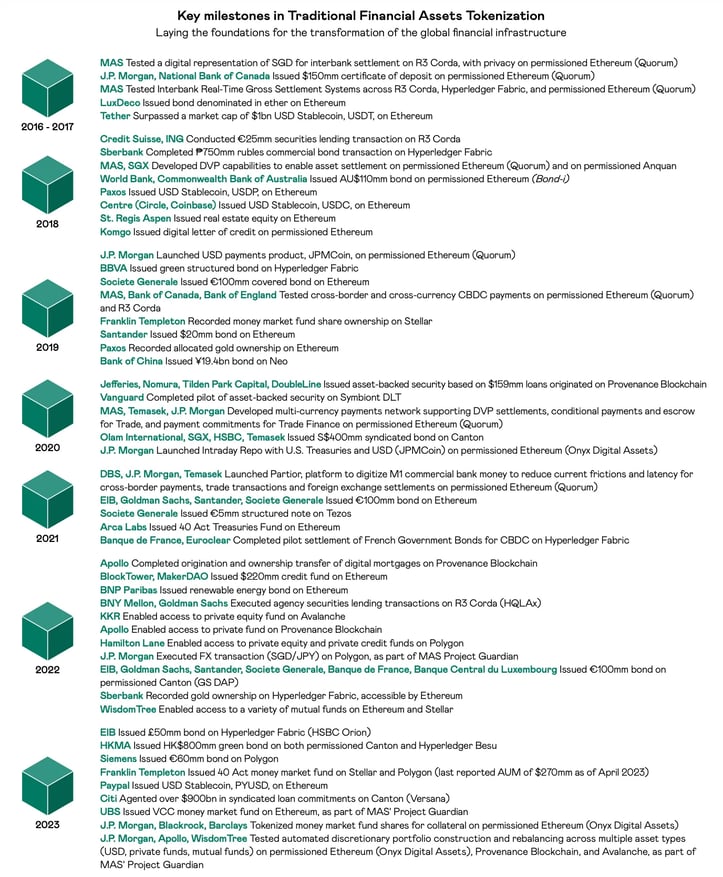

This latest proof of concept by J.P. Morgan is one of a long list they have undertaken in the past 7 years. Whilst they will help to propel the space forward, it's important to keep in mind that there's still a long road ahead for these technologies.

Fnality was built off the back of proof of concept exercises that commenced in 2015 and it’s just about to go live 8 years later. Regulation needs to adapt and change to support these projects. And whilst it's fantastic that you have regulators such as MAS working alongside J.P. Morgan and others, it’s important to be prepared for the long road ahead.

Regulated finance will not be replaced by public blockchain networks, but there will be ways in which it can leverage them. It will take time and effort, but if these latest announcements demonstrate two things, firstly, it's that change in the provision of financial services underpinned by blockchain technology is happening now, and secondly that there's no shortage of opportunities for it to bring greater efficiency across the industry, its just that it takes time.

Further Reading

For more on Fnality, you can listen to my discussion with their CEO, Rhomaios Ram. We also hosted their CTO, Adam Clark where he gave a very insightful presentation on their technology platform.

For more information on this latest phase of Project Guardian, you can read J.P. Morgan and Apollo's report.

For more on J.P. Morgan and their work with blockchain technology, you can listen to my conversation with Tyrone Lobban, Head of Onyx Digital Assets and read J.P. Morgan's Long-Term Bet on Blockchain.