The Urgent Quest for Product-Market Fit in Web3

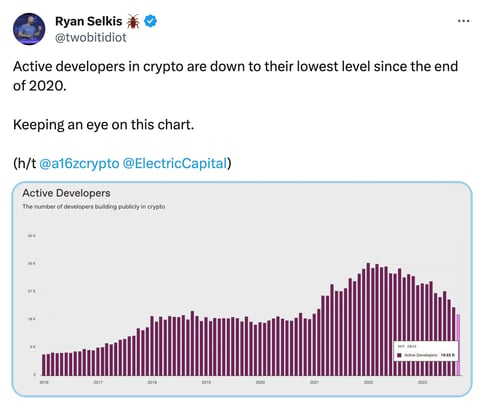

Developer activity on web3 protocols is at lows not seen since the end of 2020. The news cycles for months on end have been dominated by speculation about the Bitcoin ETF and SBF's trial. Both of which we hope to have closure on before the year's end. This repetitive news cycle isn't great for inspiring people to get involved with web3, but crypto is the most mainstream part of web3.

Outside crypto, teams continue to build and focus on scaling blockchain networks, whether it’s Ethereum via its layer 2 networks or the alt-layer one Ethereum killers. But arguably too much of the web3 community is focussed on crypto or infrastructure technologies.

Web3 has yet to find true product market fit, which brings with it hundreds of millions of new users. Finding this market fit should be the primary focus of new projects. We don't need better layer one networks with new tokens. We need teams figuring out ways of bringing new people into these ecosystems that have been built during the past 8-plus years.

Real utility tokens

My own belief is that the speculation needs to be taken out of on-chain assets and their value should be represented by the real-world asset or utility that they represent.

This would imply that the value of many tokens on their own should be zero. Instead, they have utility for the users they were intended for. For instance, if you have an NFT that is used as a hotel room key, this will only have utility to someone who wishes to access the hotel room it is tied to. It's worthless to most people.

Likewise, an in-game item represented by an NFT will be worthless to all but players of the games it can be used in.

With these examples, NFTs are providing additional utility to something that already exists. What sets them apart from the NFT frothiness that we saw in 2021-2022 was many people piled or aped into NFT purchases based on an idea. This was similar to how people piled into initial-coin offerings in 2018, they were speculators, not users.

It's important to look forward to a time when tokens are ubiquitous in our society. Where owning or using a blockchain-based token is no more complex than making a movie purchase using Apple or Google Pay on a phone, or sending funds using Paypal.

Tokens in this context will be everyday items that people use. Their primary value will be based on their utility, and the vast majority will have no intrinsic value as they will be ubiquitous much like RFID cards.

For those that do have intrinsic value, it will be based on their value to the owner. This could be in the form of art or collectables, but more commonly because they have sentimental value. They may have been obtained through a game the holder played, a concert they attended or have been a gift from a dear friend.

Financial tokens that represent securities or currencies will retain their value, but the value is tied to the underlying, as they are ‘collateralised stablecoins’. For their holders, they are a more convenient asset to hold than the physical representation which is always an alternative.

Finding product market fit

Getting from our current infrastructure-focussed ecosystem to seeing widespread adoption of tokens is the biggest challenge facing web3 now.

Finding the problems that compel people to engage with tokens is hard. The best examples that come to mind are in the developing parts of the world.

For citizens living in countries subject to hyperinflation, holding a stablecoin such as USDC on a cryptocurrency exchange appears like a safe alternative.

In addition, due to the significant charges levied by remittance payment providers, cryptocurrencies do provide a compelling alternative. Outside of these use cases, most of the activity has been driven by price speculation.

The corporate world is acutely aware of the threats and opportunities provided by this technology. Some of the world's largest finance companies are investing heavily in it. They are well-positioned to create an array of stablecoin-based products such as tokens representing deposits, fiat currencies and securities.

If they can execute well on this premise, the convenience of being able to self-custody or trade these assets 24/7, especially in the case of securities is compelling.

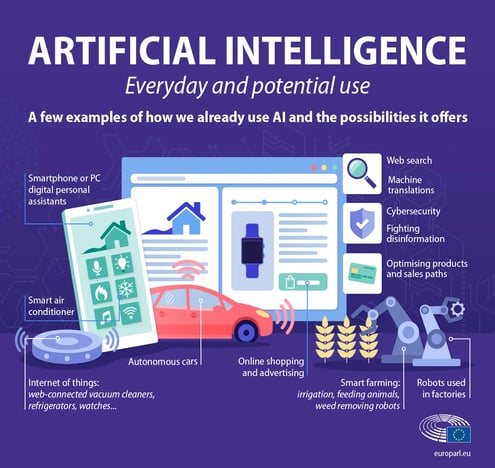

Outside of financial use cases, convenience, and ease of use will be crucial. The big breakthrough we saw this year in AI was due to the sophistication of large language models, which gave AI platforms a human-like interaction prompt.

Prior to ChatGPT, AI was associated with self-driving cars and personalised recommendations used by social networks and online retailers.

Back in 2020, this is how the European Parliament viewed the big AI opportunities

Back in 2020, this is how the European Parliament viewed the big AI opportunitiesIt wasn't clear that LLMs (Large Language Models) like ChatGPT would be the innovation that brought AI front of mind into the public's consciousness.

When native web3 assets are considered safe enough for everyday people to use, Google and Apple will provide native support for them.

I, like you have no idea when this will likely happen. But there are web3 projects which are gradually building momentum which could be very impactful down the line.

A couple of interesting examples which have created loyal communities, but are not associated with financial incentives are:

Proof of Attendance Protocols (POAPs) are NFTs which are generated at events and shared. POAP.xyz is the leader in this category, and you find many exhibitors at web3 conferences using their technology.

A POAP I received at ETHDenver

A POAP I received at ETHDenverLens Protocol is a decentralized social graph for web3. On this social graph, people can create accounts and connect with other people on Lens. Lens doesn't provide a platform beyond the social graph contracts, which leaves it up to the community to build applications on Lens.

These projects are both interesting to engage with, but for more ideas, I encourage you to attend web3 conferences, as they are packed full of teams demonstrating the latest and greatest innovations they have come up with for this technology.

Who knows, it may happen to be one of those teams that build the next breakthrough application for web3, that onboards a billion users.