Wholesale DeFi

There is a significant disconnect between TradFi and DeFi. TradFi is regulated, DeFi is not. Between the two industries lives a large void of uncertainty where startups, corporates and web3 hackers try to find ways to bridge the two.

To proponents of web3, the future is certain — it is "on-chain" whereby all financial entities evolve into being protocols living atop of blockchains. To its opponents, web3 is a Ponzi, a world inhabited by scammers and charlatans who claim to be building the future, but in fact, only care about the value of their crypto tokens. How could such technology ever be taken seriously against this backdrop?

Against this, you have the future of a $25tn industry at stake which is trying to figure out how seriously blockchain technology should be taken.

For web3 technologists, the answer is often an easy one, by representing financial assets on a blockchain, you eliminate all of the duplicate data that currently exists in various data siloes around the world held by banks and other large financial institutions. Anyone who has spent time within the financial services industry knows that the answer is more complex than this. Finance is a highly regulated industry that has had its fair share of scams, speculation and market manipulation, not unlike DeFi now.

Regulation evolved to try and protect consumers and businesses that were taken advantage of, and also ensure that companies adhere to operating practices that made it harder for them to commit fraud, either intentionally or unintentionally, or suffer security breaches and other activities that could harm them and their customers.

It's far from perfect — we still see scammers targeting the vulnerable for their savings, hedge funds getting greedy and overextending themselves (Long Term Capital Management, 3AC), companies committing fraudulent activities (Wirecard, Enron), and government bailouts.

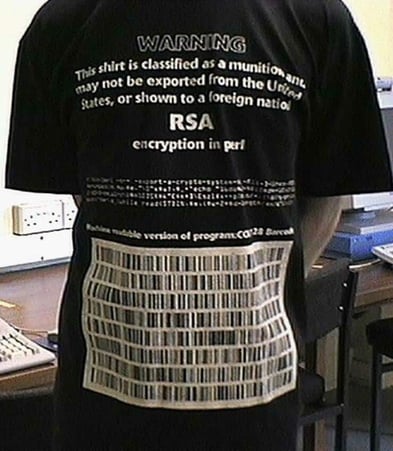

In web3, we are seeing heavy-handed approaches being used by regulators to target those individuals and companies that fall on the wrong side of the law (see Virgil Griffin and Alexey Pertsev).This has parallels with the early days of the web, where the export of cryptographic technology was severely restricted from the U.S.

It was once illegal to export this t-shirt from the U.S. or show it to foreigners

Over time regulators tend to come to their senses, but regulation is perpetually playing catchup with technology and industry trends — with regulation more often being created in reaction to events rather than proactively. This reality of regulation has a significant bearing on how fast TradFi can embrace web3 technology.

Crypto provides a mechanism to send funds via cryptocurrencies or stablecoins anywhere in the world without an intermediary. DeFi provides entirely new opportunities for investors to access products the likes of which simply weren't available pre-web3 such as the ability to create and make markets on decentralised exchanges.

In this respect with its global reach requiring only an internet connection and technical literacy, crypto and DeFi have created a democratised financial system. This is possible thanks to the trust layer provided by blockchains upon which these digital assets and DeFi protocols are built. The material gains that were possible in the crypto and DeFi ecosystems during the past couple of years created a snowball of demand for products and services to support these web3 assets and protocols. Exchanges, crypto lenders and crypto apps sprung up to facilitate the burgeoning demand from both consumers and institutions.

Effectively these businesses were focused on onboarding digital assets as a new type of asset class into the financial ecosystem, rather than embracing the underlying rails they used wholeheartedly. It does provide a glimpse of what a web3-enabled future could look like, but regulation is going to need to catch up. As it stands, huge swaths of the financial market ecosystem are ring-fenced from consumers. Access to products and services is granted by regulated intermediaries such as banks, stockbrokers and payments companies. These intermediaries then interact with one another via private wholesale financial markets, some of which are private financial networks these intermediaries are members of such as payment networks operated by Swift or Mastercard, or via financial market infrastructure companies like the DTCC, stock exchanges and clearing houses.

Given the breadth of financial services globally, these wholesale markets are giant, both with respect to the number of participants involved in them, and the scale of the transactions they are facilitating globally. This scale brings significant regulation and with that a lot of complexity and inefficiency that has built up over time. These are the markets where blockchain technology has a significant opportunity to impact financial services. However, it's unlikely to be via the same playbook used by DeFi. The regulatory constraints bring tight requirements about which companies can be members of these wholesale financial networks. Infrastructure providers have to overcome significant regulatory hurdles to establish as service providers in these ecosystems.

The way in which blockchain technology is often embraced here is through private-permissioned blockchains that can be controlled and made to comply with regulatory guidelines. Public blockchain networks, without strong identity, access and privacy guarantees are going to struggle in a number of scenarios given what is at stake in such networks. That isn't to say public blockchains will not be able to benefit such environments, consumer cross-border payments are already one part of the financial ecosystem that has been hugely disrupted by web3. However, it is ultimately going to be down to the regulators to decide what activities can and cannot take part in as far as the regulated industry is concerned.

Without solutions to identity, access and privacy concerns this is not likely to happen. It's possible therefore that we see parallels of what happened with the world wide web play out in TradFi for web3. This is where consumers are primary beneficiaries of the web3 ecosystem. The dot-com boom incentivised many financial institutions to create online services for their customers using web technology such as HTML and web browsers, but behind the scenes, they relied on the same old infrastructure to service their clients as they had done for years. In the wholesale markets, tightly controlled, private networks built with their own proprietary protocols were created to serve their needs. They were built on the internet's TCP/IP stack but didn't require the same consumer-facing technology as the web.

Hence we've seen a lot of these entities create private-permissioned blockchains to take advantage of web3 technology, as they are used to working in private networks. These networks are more likely to appeal to regulators given they're closed and tightly controlled, but are entirely separate from public networks. It's feasible in the future that the wholesale markets exist in similar ways to their current form, but with blockchain technology powering them providing greater efficiencies. This is in part because public blockchains don't have the permissioning, privacy and scalability required to support many of their use cases, but also because public networks are unregulated entities.

This means that in the near term, in the wholesale financial markets, many private permissioned networks will likely grow and thrive, with explorations of public networks continuing but simply not being appropriate for all use cases. Perhaps there will be a greater convergence between TradFi and DeFi/web3 than we saw with web1/2 and the wholesale markets. But without regulatory support, it is going to be an uphill battle.