Why Blockchain is Great for Records of Ownership

One of blockchain’s most significant use cases is in simplifying records of ownership or “tokenization” of assets. This stems from blockchain being tamper-evident: a single change to previously recorded data, no matter how small or in which part of the blockchain, alters all subsequent data on the chain. In other words, while information can be updated, something that was once recorded can never be changed or erased.

Any given business deals with a multitude of other businesses or suppliers on a daily basis, and they need to be able to trust the data they receive from them. Usually, they would update their internal records with new information. That way, all participants have their own databases and do not rely on unchecked information from each other. However, the structure of blockchain removes that redundancy by offering a transparent and tamper-proof environment for everyone.

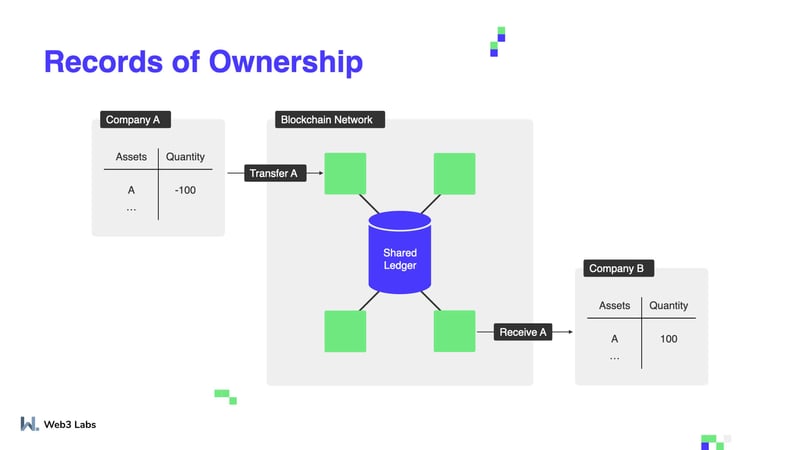

This approach also simplifies the process of transferring ownership of both digital and physical assets between two entities, where both have access to the same blockchain. Instead of having to update an internal record, both parties agree on updating having a common representation of that asset on the blockchain, saving time and effort in the process. The format of this asset can often be represented as a token.

Another significant obstacle in records of ownership is the problem of finding a standardized format for digital assets that allows them to be transferred between entities. Companies may choose to use different formats, making switching to another one a costly and time-consuming process, along with posing the question of which company should be the one to make the switch. With blockchain, all participants use the same format as it exists as common code on the blockchain which they can all interact with (of course with a degree of permissioning), which differs from other non-distributed or shared solutions.

What Users Can Do

As blockchain lets you establish any asset in a digital form and record ownership, the first step for those looking to implement the technology should be in seeing which of their existing assets would benefit from such an approach. This can be something that already exists, either physically or in a digital sense, that could use a blockchain representation.

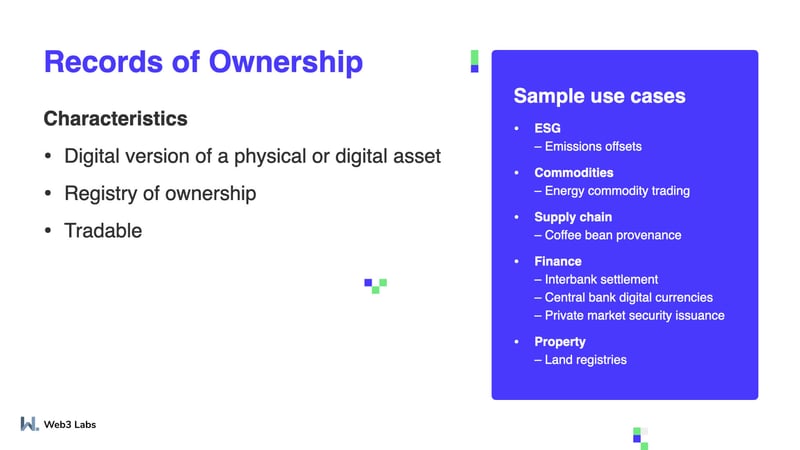

One such example is in the ESG (Environment, Sustainability and Corporate Governance) sector with emissions offsets. A company wanting to offset their carbon footprint will calculate their emissions and then purchase credits from companies that prevent or remove emissions for an equivalent amount in an effort to stay green. Companies working on the latter can be planting trees or introducing clean energy technologies into developing countries, which can be easily represented on the blockchain and sold as necessary. ClimateTrade is doing exactly that: letting companies select among their projects to achieve carbon neutrality, they’re using blockchain to introduce much-needed transparency to the space.

Another question to ask is whether such an asset would be useful to your customers or suppliers. One such example is in the trading of commodities. Since there are so many participants in the creation of a commodity, the transfer of ownership requires a significant paper trail. By moving it to the blockchain, not only is the paper trail minimized, but the buyer can also check the authenticity of the asset through the data on the chain. Vakt, which started operations in 2018, is aiming to modernize physical energy commodities trading by adding blockchain into the mix. This will let it handle these commodities every step of the way, removing the need for paper contracts they call “cumbersome.” Vakt has now signed up two-thirds of the companies responsible for deals in North Sea crude grades. It is now preparing to expand into new markets and commodities.

The supply chain industry is another large industry where blockchain is leaving its mark. An added benefit of this approach is that this also creates a seal of authenticity that can be visible to your end customer if you so prefer, as a mark of quality. As there are raw materials that are often acquired in controversial ways, from coffee beans to cobalt mines that utilize child labor, blockchain tracks every step of the way and can help uproot these practices. Starbucks, for example, has introduced a blockchain that registers the details of coffee beans from the moment they’re grown until they end up in a customer’s cup, so the consumers can know exactly where the beans are from.

Perhaps the most significant use case for a wide audience is the creation of central bank digital currencies (CBDCs). Although there are currently none live, many central banks are working on adding the digital aspect to their fiat currencies through implementing blockchain, as this technology is the first one to fulfill their rigorous safety standards. Sweden is among the lowest cash-usage countries in the world, and their pilot project for the e-krona is running between February 2020 and February 2021, started by the Swedish Riksbank in partnership with Accenture. Additionally the Bank of England recently published a report detailing the key requirements for CBDCs.

Common Arguments Against

.png?width=800&name=Records%20of%20ownership%20Inline1%20(1).png)

Prospective blockchain users often cite a few main reasons why they’re wary of using the technology:

- High complexity: blockchain is admittedly complex—but choosing the right team, platform, and use case can reduce this, if not completely eliminate that complexity. This is not too different from any other conventional technology: yes, setting up electricity in a new home is extremely complicated and should only be attempted by professionals, but in the end, you won’t be seeing the wires—you’ll be turning on the light or using the oven.

- Can’t these assets be stolen by hackers? Realistically speaking, anything can be the target of malicious actors. This is why we recommend starting with a private, permissioned blockchain backed by a consortium. Not only does this add another layer of security to an already secure technology, but the tokens themselves will be worthless outside of the consortium, which you have the controlling stake in. But, as we’ve already established, data residing on the blockchain cannot be changed, and new additions to the chain are visible to everyone (unless privacy techniques are used), which ensures transparency of asset ownership among participants.

Final Words

What other industries would benefit from blockchain as a solution for records of ownership? We’ve only scratched the surface here and have plenty of other examples we could discuss. If you’d like to learn more and understand the opportunities blockchain presents to your business, feel free to sign up to one of our upcoming Principles of Successful Blockchain Deployments Webinars. These cover many other considerations for successfully deploying a blockchain solution. In the meantime, check out our other articles covering other use cases, platform and team considerations, as well as an overview of the benefits of blockchain.